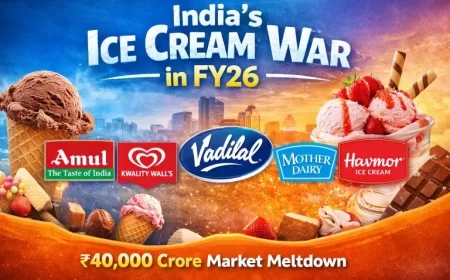

India's ice cream market is booming, Expected to reach USD 5 billion by FY25: Check the Trends, growth, and competition

Check the growth opportunities and major players. With a focus on factors such as the country's large dairy industry, consumer trends, and online retail channels, the article provides insights into the key drivers behind the market's expansion.

According to a report by Wazir Advisors, the Indian ice cream market is expected to surpass USD 5 billion by the end of FY25, with the market currently valued at USD 3.4 billion. The report attributes this growth to the expansion of domestic ice cream brands beyond major cities and the rising interest in international brands.

The major players in the market are Gujarat Co-operative Milk Marketing Federation Ltd (Amul), Vadilal Industries Ltd, Mother Dairy Fruit & Vegetable Pvt Ltd, Hindustan Unilever Limited, Devyani Food Industries Ltd, Graviss Foods Pvt Ltd, Dinshaws Dairy Foods Pvt. Ltd, Havmor Ice Cream Pvt Ltd, Ramani Icecream Company Limited, Dairy Classic Ice Creams Pvt. Ltd., and General Mills Inc., among others.

Most of the popular ice cream brands are regional with a multitude of brands concentrating on only one or two districts or in some cases only one state. Ice-cream, as a category, has been growing at a healthy CAGR of ~10-15%.

Impulse ice cream leads the market with a value share of 50%, while western flavours like vanilla and chocolate are the most popular. Despite high price sensitivity, there is room for growth by increasing consumption levels and penetration in tier II and III cities. The ice cream market has also adapted to the digital mode of selling due to reduced out-of-home consumption, with a focus on in-home consumption and doorstep delivery.

Quick commerce (QC) has emerged as a key player in the delivery of indulgences like ice cream and chocolates, with 10% of users reportedly ordering such items. Frozen food platforms like Frogo are also gaining prominence by offering an end-to-end cold chain for frozen food, including ice cream.

Major players in the ice cream market like Vadilal, Amul, Unilever, and Cream Bell are expanding their presence in the QC space and focusing on hyperlocal business models to cater to consumer needs. Baskin Robbins, Vadilal, and Noto have partnered with hyperlocal fulfilment platforms to expand their delivery footprint through dark stores. Hindustan Unilever highlighted that more than 10% of their ice cream business was generated via QC.

As per swiggy, 2022 sales report Choco Chip, Alphonso Mango and Tender Coconut being the most ordered ice-cream from swiggy.

India's warm and humid climate has contributed to the growing popularity of ice cream as a dessert in the region. Dessert sales are continually increasing due to changing food preferences among customers. Maharashtra holds the largest market share in the ice cream market, representing nearly 15% of the total market share in India. Other major regions, including Uttar Pradesh and Gujarat, follow suit.

The Indian ice cream market is driven by the country's significant dairy production and the rise in disposable income and urbanisation. Consumers are increasingly seeking premium and unique ice cream flavours, including regional and traditional varieties such as kulfi, as well as exotic flavours like Anjeer, Badam, Kesar, Pista, Nolen Gur, and Rajbhog. The market is further supported by the growth of online retail channels, improved cold chain infrastructure, and the launch of gluten-free and vegan options. Intense competition between leading domestic and international players is also fueling market growth.

Upcoming trends in the market include cross-cuisine flavours, immunity boosters, plant-based or vegan ice creams, and wellness ice creams such as probiotics, gluten-free, sugar-free, and low-fat. Homegrown ice cream brands like Noto, Good Fettle, and Get a Whey are gaining popularity among consumers and investors. Havmor, which was acquired by Lotte Confectionery, plans to invest Rs 450 crore over a five-year period to expand its capacity in India.

What's Your Reaction?

Like

19

Like

19

Dislike

0

Dislike

0

Love

4

Love

4

Funny

0

Funny

0

Angry

1

Angry

1

Sad

1

Sad

1

Wow

14

Wow

14